Is Operating the Same as EBITDA? [2023 UPDATE]

Operating income includes all sources of revenue, minus all operating expenses. This measure provides a more holistic view of a company's profitability, as it includes all operating income and expenses. EBIT excludes interest and taxes from operating income, providing a narrower view of profitability. This measure is often used to compare.

EBIT vs Operating Are They Both Same? Know the Top Differences! YouTube

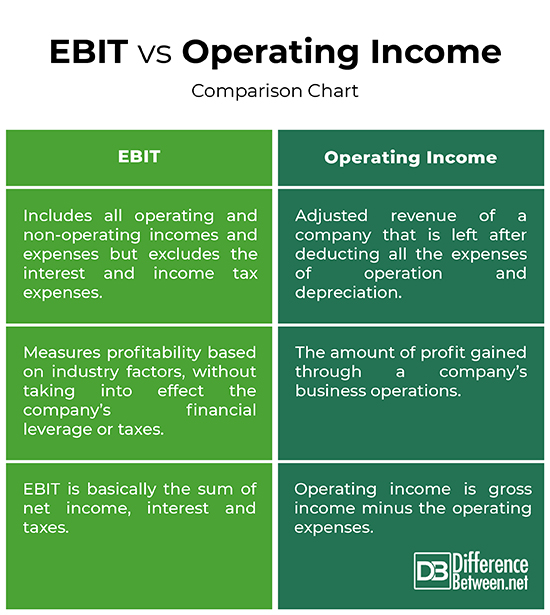

One key distinction between EBIT and Operating Income lies in the treatment of interest and taxes. EBIT, as the name suggests, excludes these two factors from its calculations, focusing solely on the operational aspect of a company's performance. On the other hand, Operating Income takes into account both interest and taxes when determining the.

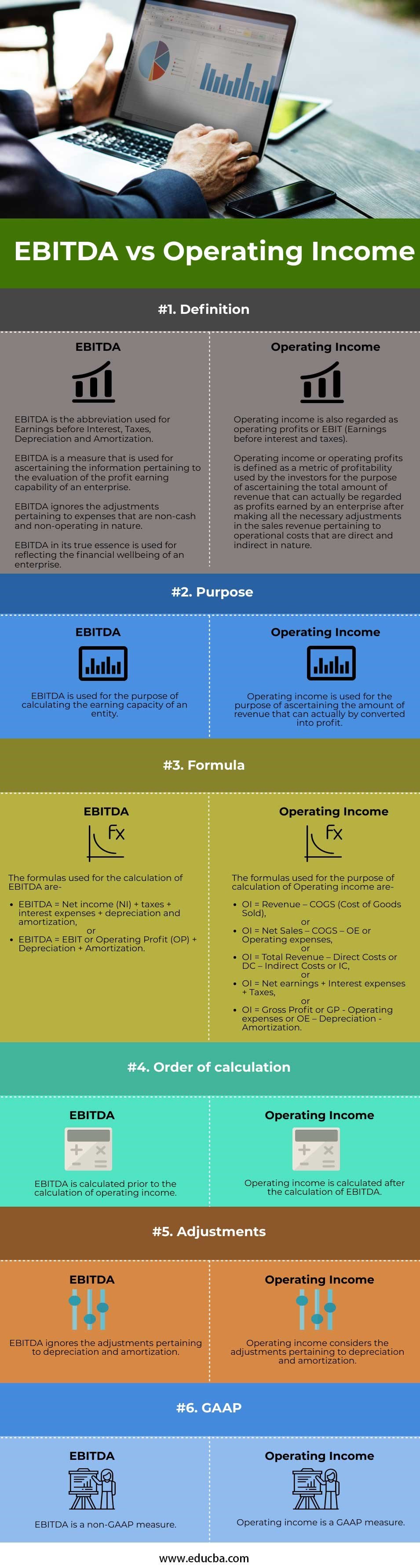

EBITDA vs Operating Top 6 Differences You Should Know

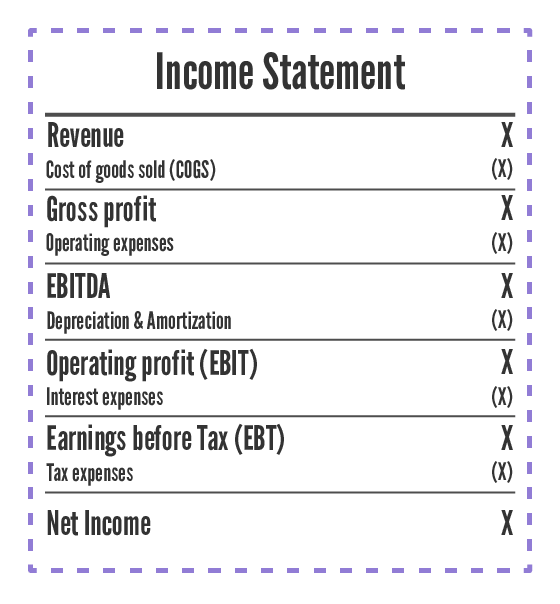

Operating income is often referred to as the earnings before interest and taxes (EBIT). Operating income is the gross income minus the operating expenses. Gross income is the amount of money left after deducting the costs of goods sold from the revenue. Operating expenses include all the costs involved with running the core business operations.

EBITDA vs Operating Top Differences You Must Know! YouTube

To understand the key differences between EBIT vs. operating income, it's essential to review their purpose and method of calculation. You can calculate EBIT, sometimes called operating income, by totalling the company's income before taxes. If you divide your EBIT by your sales income, this provides you with an operating margin.

EBITDAR vs. EBITDA vs. EBITA vs. EBIT vs. EBT vs. EBIAT vs. Adjusted EBITDA 365 Financial Analyst

The key difference between EBIT and Operating Income is that it refers to the business's earnings earned during the period without considering the interest expense and the tax expense of that period. In contrast, operating income refers to the income earned by a business organization during the period under consideration from its principal.

EBIT vs Operating Profit Explained with Examples YouTube

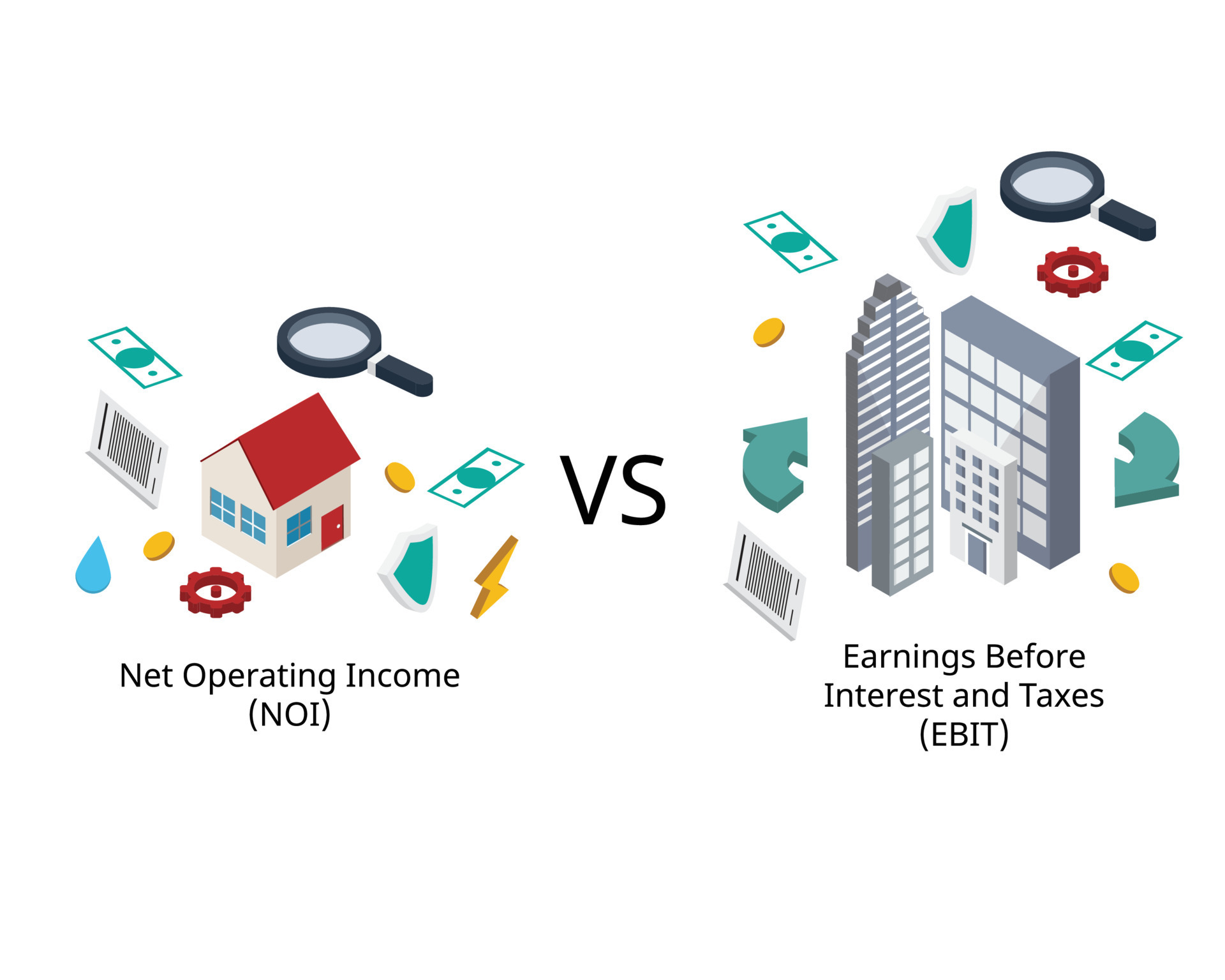

Key Takeaways. Calculating net operating income (NOI) involves subtracting operating expenses from a property's revenues. Calculating earnings before interest and taxes (EBIT) uses the same.

Net Operating or NOI compare to EBIT or Earnings before interest and taxes 22227080

Here are some of the key differences between operating profit and EBIT: EBIT includes non-operating income, whereas operating income does not. EBIT includes non-operating expenses, whereas operating income does not. EBIT refers to net income before deducting interest and income taxes, whereas operating income refers to an organization's gross.

Difference Between EBIT and Operating Difference Between

Meaning of Operating Income: Operating income is an estimation that shows the amount of an organisation's income that will ultimately become benefits. Operating income is like an organisation's earnings before interest and taxes (EBIT); it is likewise alluded to as the working benefit or repeating benefit. The one major distinction between.

EBIT vs. EBITDA vs. Net How They Differ, and How New Accounting Rules Affect Them YouTube

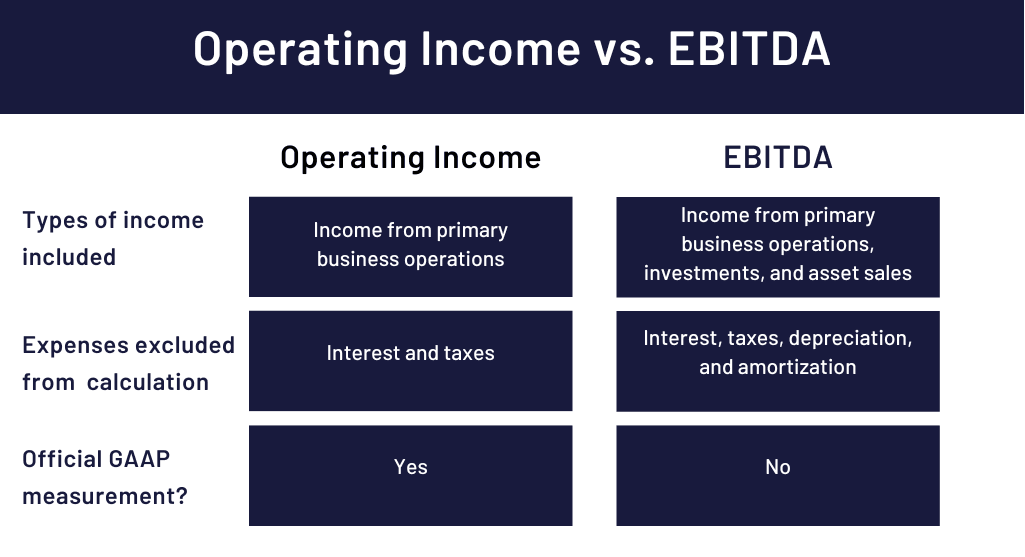

The first difference between operating income vs. EBITDA is the usage of interest and taxes. EBITDA is an indicator that calculates the income of the company before paying the expenses, taxes, depreciation, and amortization. On the other hand, operating income is an indicator that calculates the company's profit after paying the operating.

Difference between EBIT and Operating Profit Difference Betweenz

Difference Between EBIT vs Operating Income. EBIT vs Operating Income refers to the measurement used for showing the profitability generated by the company in a period out of its operating without considering the interest and the tax expenses. It highlights the company's capability to generate profits and is therefore used by the investors.

EBIT vs Operating Key Differences Demystified!

Operating margin, which is expressed as a percentage, is a measure of the revenue left over after accounting for expenses. It is the amount of profit that a company makes on every dollar once its.

Difference Between EBIT and Operating Profit

The main difference between EBIT and Operating Income lies in what they exclude from the total revenues. While EBIT subtracts all the expenses except for interest and tax, Operating Income also excludes depreciation and amortization in addition to interest and tax.

Comparing Operating & EBITDA Finance Strategists

However, there is a significant difference between the two. EBIT stands for earnings before interest and taxes, while operating income refers to a company's earnings from its core operations. Operating income only takes into account revenue generated from the business' primary activities like sales of goods or services minus direct costs.

:max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

EBIT vs. Operating What's the Difference?

The key difference between EBIT and operating income is that operating income does not include non-operating income, non-operating expenses, or other income. Key Takeaways.

Net Operating or NOI compare to EBIT or Earnings before interest and taxes 22267493

The difference between EBITDA and operating income is best understood by studying a real income statement, such as this one from JC Penney Company Inc. , released May 10, 2018: Operating income.

What is the difference between EBIT and EBITDA? شبکه اطلاع رسانی طلا و ارز

One crucial difference between EBIT and Operating Income is that EBIT disregards non-operating income and expenses, such as interest and taxes. EBIT: EBIT focuses solely on the company's operational efficiency and profitability. It provides a clearer picture of how well a company is performing in its main business activities.

- Tennis Deutsche Meisterschaften Senioren 2023 Ergebnisse

- Raus Aus Der Single Hölle Staffel 3

- Besetzung Von La Maison Du Mal

- Anstehende Veranstaltungen Für Bruce Springsteen

- Für Was Sind Antioxidantien Gut

- Arduino Oled 128x64 I2c Beispiele

- Wann War Silvester Am Sonntag

- Kunstrasen Verlegen Lassen In Der Nähe

- Filme Und Serien Von Ina Paule Klink

- Ibc Container 300 Liter Gebraucht