Payment for Order Flow The Complete Guide

To wit: Robinhood's exploding confetti and gamification. And business is booming. The 12 largest U.S. brokerages earned a total of $3.8 billion in payment for order flow revenue in 2021, per.

Payment for Order Flow The Complete Guide

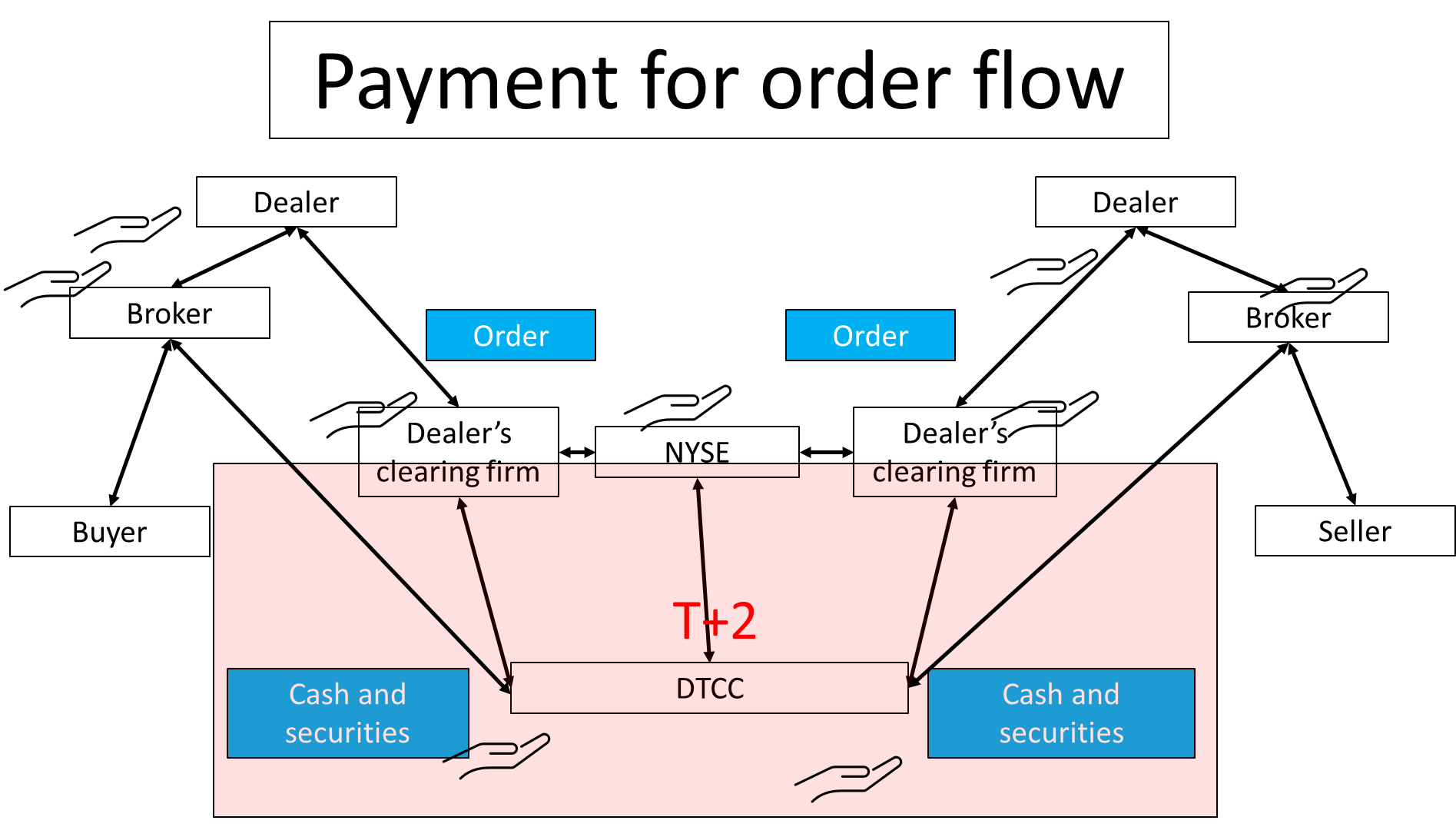

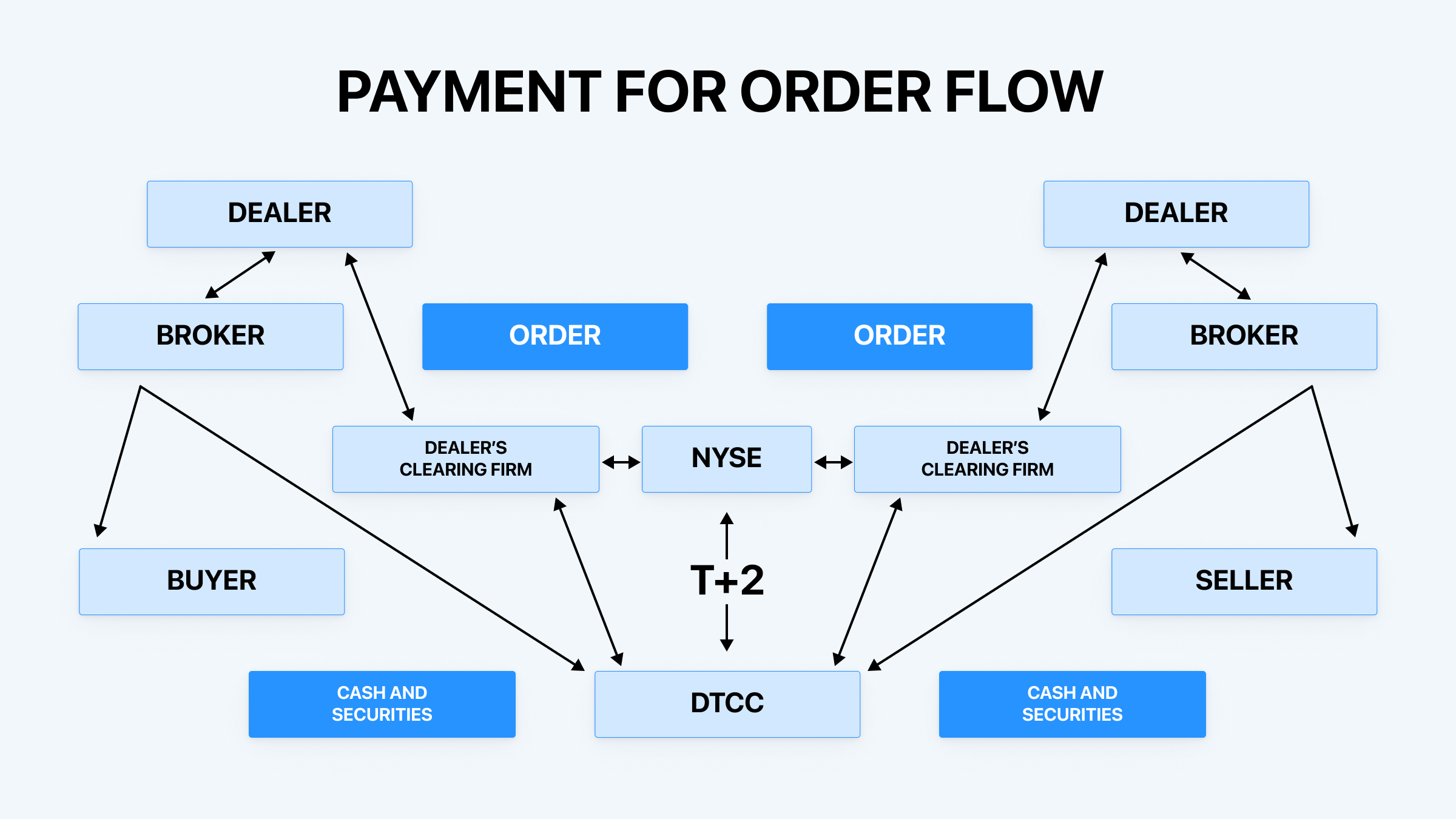

Payment For Order Flow: A payment for order flow is the compensation and benefit a brokerage receives by directing orders to different parties to be executed. The brokerage firm receives a small.

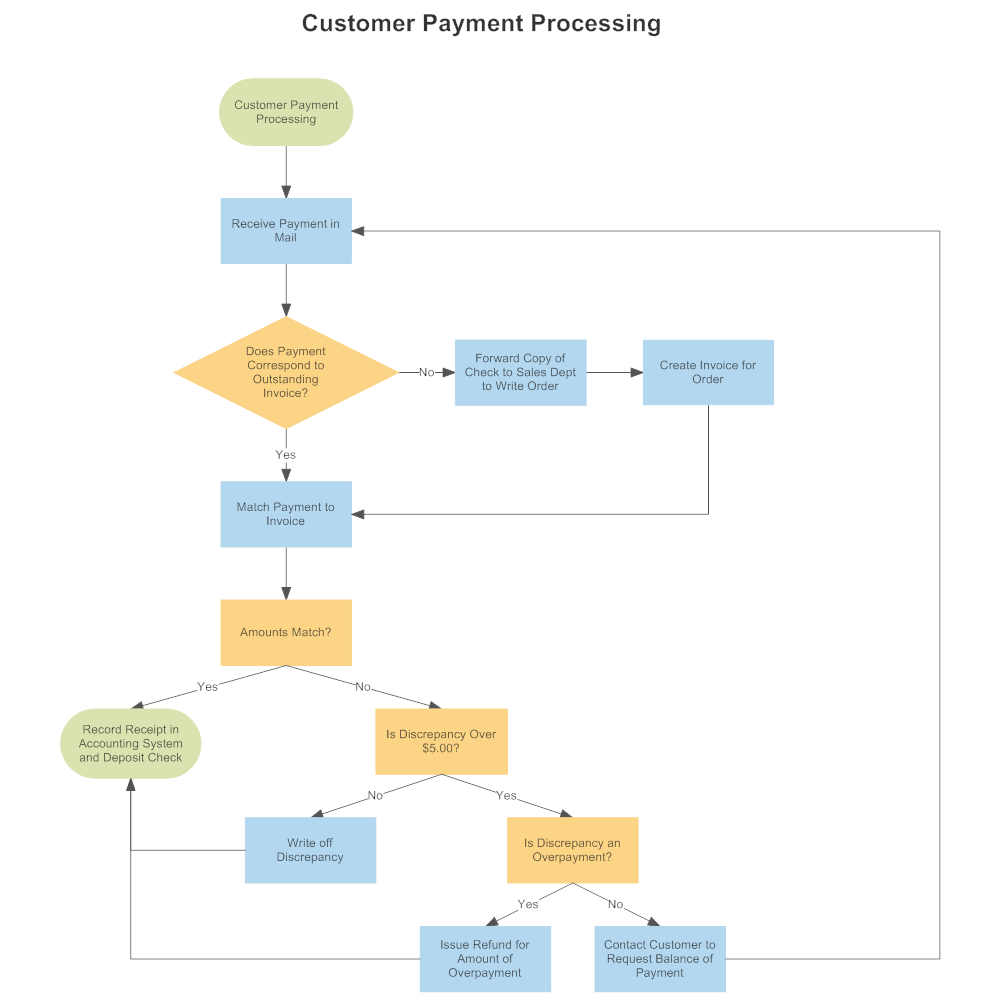

Customer Payment Process Flow

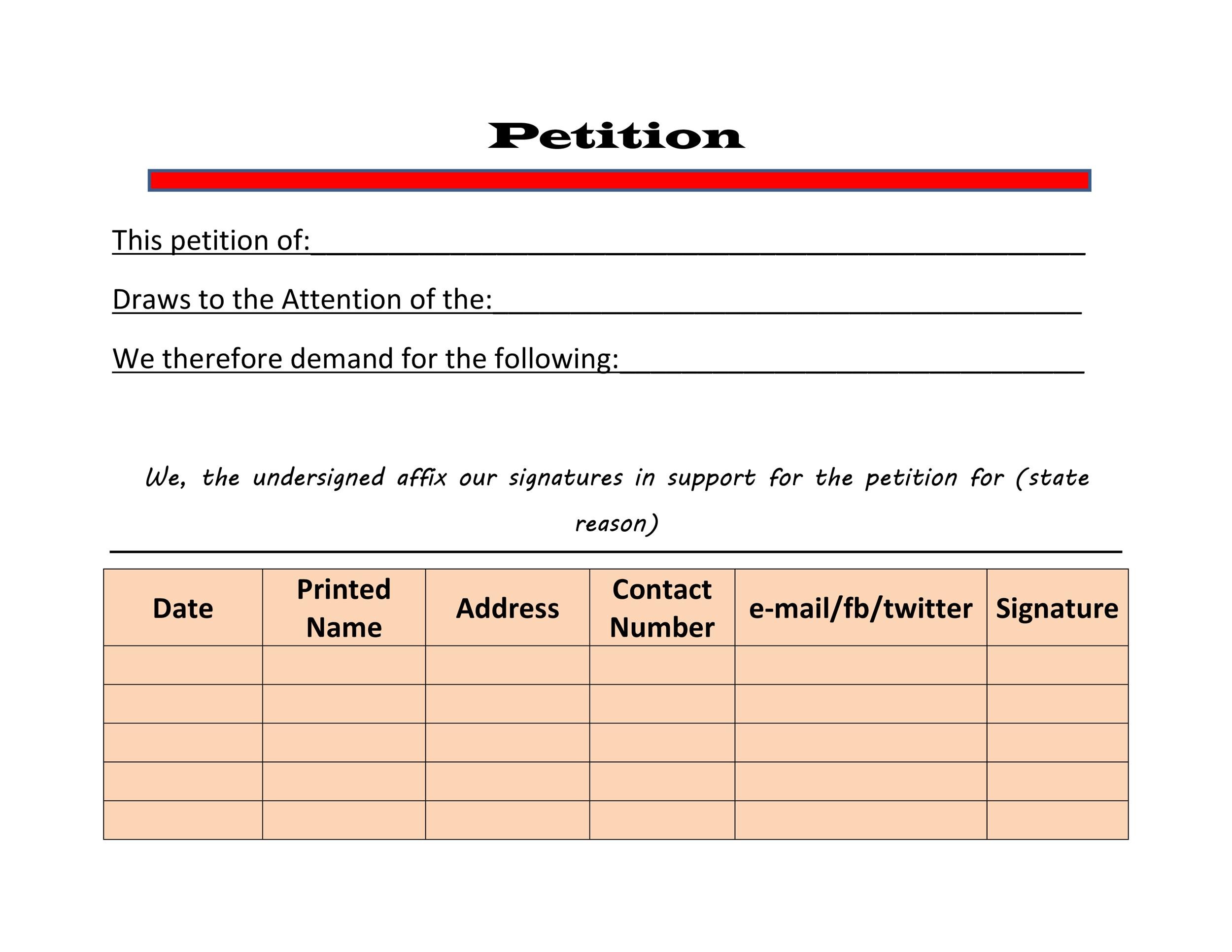

Rulemaking Petition to prohibit payment for order flow. Rulemaking Petition to prohibit payment for order flow. petn4-806.pdf (218.72 KB) Rulemaking Petition to prohibit payment for order flow. STAY CONNECTED 1 Twitter 2 Facebook 3 RSS 4 YouTube 6 LinkedIn 8 Email Updates. About The SEC. Budget & Performance; Careers; Commission Votes;

Payment for Order Flow The Complete Guide

Die EU will Payment for Order Flow verbieten. Gerade für Kleinanleger bringt das PFOF aber viele Vorteile. Gebührenfreier Handel von Kleinaufträgen ist hier möglich. ETF Sparpläne können gebührenfrei bespart werden. Jeder Kunde kann bei seinem Broker einsehen, über welche Handelsplätze und zu welchen Gebühren die Order ausgeführt wird.

Payment for Order Flow The Complete Guide

called payment for order flow (PFOF) by entities known as market makers, internalizers, or wholesalers, such as the market dominant Citadel and Virtu, which execute the orders. The wholesalers can profit by earning the bid-ask spread (matching buyers generally willing to pay a slightly higher price to sellers generally willing to take a lower one)

PFOF Payment For Order Flow FourWeekMBA

Payment for order flow (PFOF) refers to a practice where a stock broker receives compensation for routing an order to a particular market maker. In other words, it means your broker is getting paid to process your trades though a certain third party. When you normally place a trade, your broker works with a clearing fim to route the order.

Payment for Order Flow Financial fitness, Flow, Payment

Payment for Order Flow (PFOF) is the practice of execution venues to make payments to a brokerage firm if the brokerage firm routes client orders to these execution venues. Following the "Gamestop" incident, PFOF has become the subject of increased scrutiny in the US and the EU. The European Commission has recently proposed legislation to ban this practice altogether.

The Detailed Information • Payment For Order Flow • 2021 Smile and Happy

Payment for Order Flow. As a way to attract orders from brokers, some exchanges or market-makers will pay your broker's firm for routing your order to them - perhaps a penny or more per share. This is called "payment for order flow." Payment for order flow is one of the ways your broker's firm can make money from executing your trade. The.

Payment for order flow The relationship between brokerages and wholesalers explained YouTube

In payment for order flow (PFOF), market makers pay brokers for filling customer orders. In these flash-auctions, the best bid/offer wins; payment is sent from the market maker to the broker for filling the order, and the customer is filled. Outwardly, wholesale market makers welcome an end to PFOF as this means they'll simply fill the same.

What is Payment for Order Flow, and Why Should Investors Care? Healthy Markets

Petitions must be filed with the Secretary of the Commission. Petitions may be submitted via electronic mail to [email protected] (preferred method) or via physical mail at 100 F. Street NE, Washington, D.C. 20549-1090. To help us process your petition more efficiently, please use only one method. Petitions must contain the text or.

Payment For Order Flow. Think Twice. Seeking Alpha

There are four types of third-parties willing to pay for order flow: Wholesalers are electronic trading BDs utilizing high frequency trading, algorithmic and low latency trading programs to carry out order executions. These firms use speed and access to split spreads down to the 10,000ths of a penny to capitalize on order flow liquidity.

What Is Payment for Order Flow & How Does It Work?

The European Securities and Markets Authority (ESMA), the EU's securities markets regulator, is issuing a public statement to remind firms that the receipt of payment for order flow (PFOF) raises significant investor protection concerns. It also highlights key MiFID II obligations aimed at ensuring firms act in their clients' best interest when executing their orders.

Payment for Order Flow (PFOF) Explained Public Finance International

EU-wide PFOF ban on the horizon. As part of its 2021 Capital Markets Union Package published on 25 November 2021, the EU Commission (" Commission ") has proposed a Regulation amending the Markets in Financial Instruments Regulation (MiFIR), which introduces some targeted amendments to the main piece of market infrastructure regulation in the EU.

DeFi use cases Iniciar en el mundo del bitcóin

Petition Rule . Rulemaking Petition to prohibit payment for order flow. Resources. Petition Rule: SEC Issued Version (pdf 218.72 KB) Details. File Number. 4-806. Rule Type. Petition. Release Number petn4-806. SEC Issue Date July 8, 2023. SOCIAL MEDIA 1 Twitter 2 Facebook 2 Instagram 3 RSS 4 YouTube

30 Petition Templates + How To Write Petition Guide

Danuta Hübner, a senior lawmaker in the European Parliament, said in a draft statement seen by the Financial Times that the concerns around the practice known as payment for order flow are.

Payment For Order Flow & The SEC’s Plan To End It Secular Bull and Bear Market

Payment for order flow (PFOF) is the compensation that a stockbroker receives from a market maker in exchange for the broker routing its clients' trades to that market maker. It is a controversial practice that has been called a "kickback" by its critics.Policymakers supportive of PFOF and several people in finance who have a favorable view of the practice have defended it for helping develop.

- Khao Sam Roi National Park

- Lancaster Concentrate Eau De Toilette 100 Ml Douglas

- Werden Hämorrhoiden Bei Darmspiegelung Erkannt

- Billiards Vs Pool Vs Snooker

- Besetzung Von Power Book Iv Force

- Unsere Kleine Farm Cassandra Und James

- Love Me Like You Do übersetzung

- Iphone 11 Pro Vs Iphone 13

- Best Western Plus Sikeston Mo

- Dragon Ball Xenoverse 2 Ps5