A Quick Intro to PCI DSS (Payment Card Industry Data Security Standard) Nahan

The Payment Card Industry Data Security Standard ( PCI DSS) is an information security standard used to handle credit cards from major card brands. The standard is administered by the Payment Card Industry Security Standards Council, and its use is mandated by the card brands. It was created to better control cardholder data and reduce credit.

PPT PCI Compliance PowerPoint Presentation, free download ID1656238

PCI DSS is a set of security standards established to safeguard payment card information and prevent unauthorized access. Developed by major credit card companies, including Visa, MasterCard, and American Express, the standard aims to create a secure environment for processing, storing, and transmitting cardholder data.

PCI DSS Clavis Segurança da Informação

This document, PCI Data Security Standard Requirements and Security Assessment Procedures, combines the 12 PCI DSS requirements and corresponding testing procedures into a security assessment tool. It is designed for use during PCI DSS compliance assessments as part of an

PCI DSS Payment Card Industry Data Security Standard Acronym, it Security Concept Background

Note: The PCI DSS v4.0 standard is scheduled for completion six months prior to the release of the supporting documentation, training, and program updates that are required to support the use of PCI DSS v4.0. The PCI DSS v4.0 standard will therefore be available for 2 years prior to the retirement of PCI DSS v3.2.1.

PCI DSS Understanding Payment Card Industry Standards Sapphire

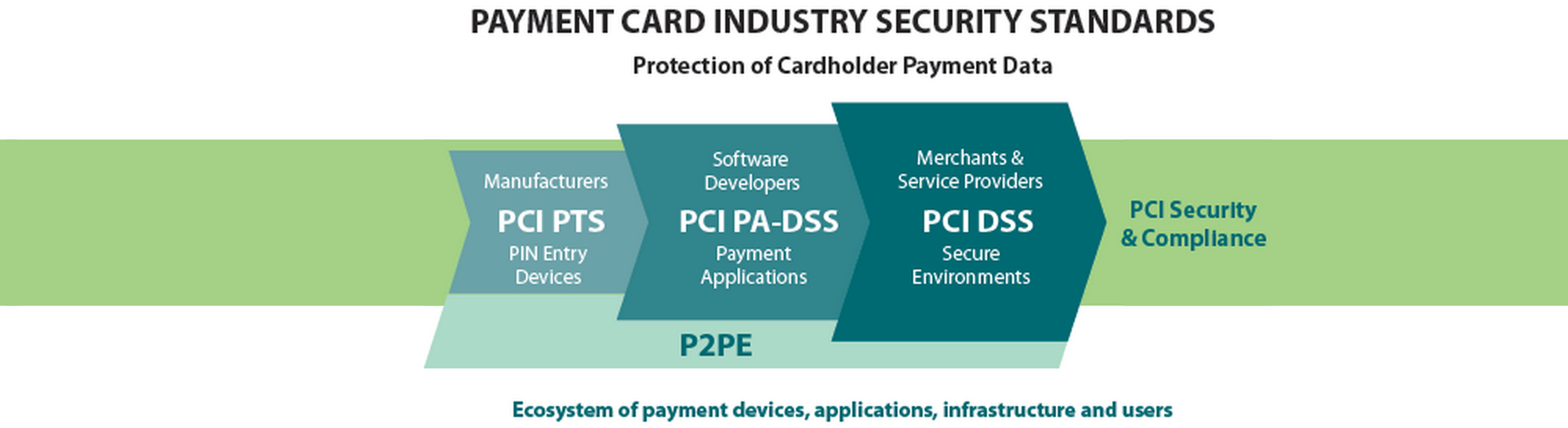

The PCI Data Security Standard (PCI DSS) and other applicable PCI Standards are intended for entities that store, process or transmit payment account data, entities accepting or processing payment transactions, and for developers and manufacturers of software and devices used in those transactions.

Implement the 12 best practices of PCIDSS security compliance within your organization? by

With the ink barely dry on the newest version of the industry standard for payment data protection, the PCI Data Security Standard (PCI DSS), what do organizations need to know about PCI DSS 3.2? In this blog post with Chief Technology Officer Troy Leach, we look at what's new in this version of the standard.

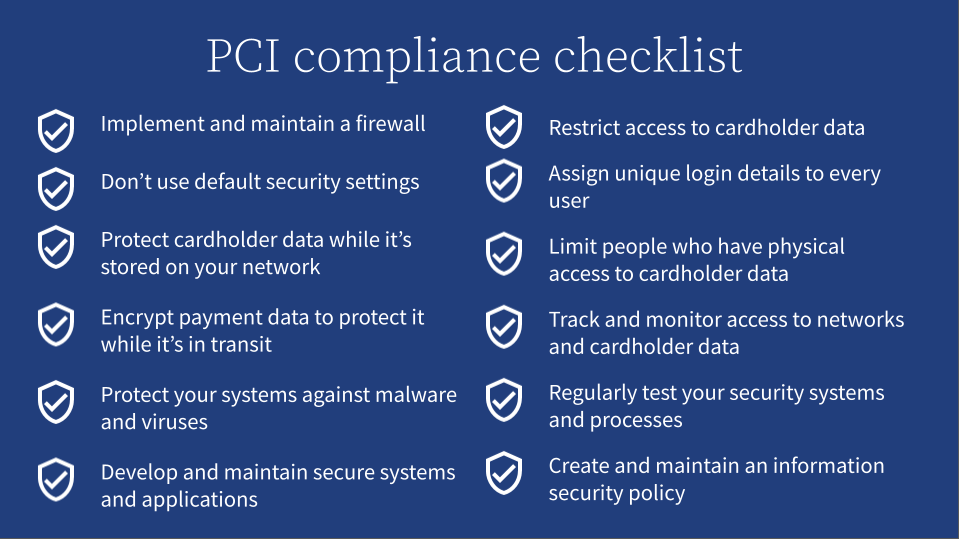

PCI compliance checklist Protect your customers’ credit card data CallRail

PCI DSS stands for "Payment Card Industry Data Security Standard" (PCI DSS). The PCI DSS framework guides businesses with robust processes for securing cardholder transaction data and card authentication information. It is intended to protect both cardholder data and authentication data with requirements that help prevent, detect, and react.

.png)

PCI DSS Qué Es y 5 Ventajas de Aplicarlo en tu Empresa

PCI DSS overview. The Payment Card Industry (PCI) Data Security Standards (DSS) is a global information security standard designed to prevent fraud through increased control of credit card data. Organizations of all sizes must follow PCI DSS standards if they accept payment cards from the five major credit card brands, Visa, MasterCard.

Payment Card Industry Data Security Standard (PCI DSS) 3.0

This Quick Reference Guide to the PCI Data Security Standard (PCI DSS) is provided by the PCI Security Standards Council (PCI SSC) to inform and educate merchants and other entities involved in payment card processing. For more information about the PCI SSC and the standards we manage, please visit www.pcisecuritystandards.org.

(PCI DSS) A Practical Guide to the Payment Card Industry Data Security Standard by ISACA

PCI Data Security Standard (PCI DSS) is a global standard that provides a baseline of technical and operational requirements designed to protect account data. The next evolution of the standard- PCI DSS v4.0- is now available. Below is the PCI DSS v4.0 At a Glance. This resource provides a snapshot of what is new in PCI DSS v4.0. Make sure to.

Official PCI Security Standards Council Site Verify PCI Compliance, Download Data Security and

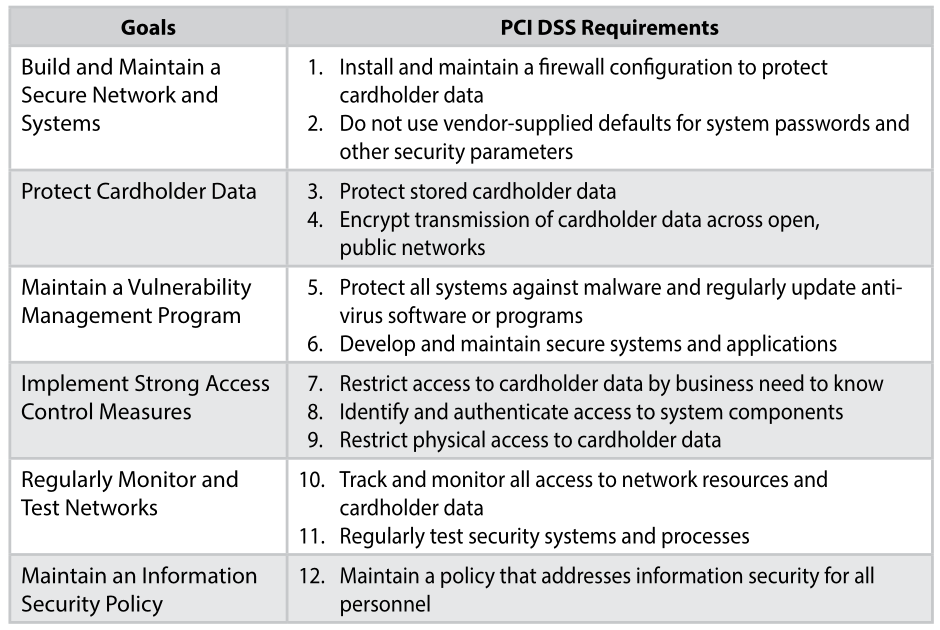

The PCI Data Security Standard PCI DSS is the global data security standard adopted by the payment card brands for all entities that process, store or transmit cardholder data and/or sensitive authentication data. It consists of steps that mirror security best practices. Goals PCI DSS Requirements Build and Maintain a

PCI Data Security Overview Presentation for Merchants

What is PCI DSS? The Payment Card Industry Data Security Standard (PCI DSS) is a framework developed by the Payment Card Industry Security Standards Council (PCI SSC) to help secure and protect all payment card account data.. Launched on September 7, 2006, PCI DSS defines baseline technical, physical, and operational security controls necessary for protecting payment card account data.

Pci Data Security Standards (Pci Dss) HighImpact Strategies What You Need To Know

PCI Data Security Standard (PCI DSS) is a global standard that provides a baseline of technical and operational requirements designed to protect account data. The next evolution of the standard- PCI DSS v4.0- is now available. This PCI DSS Resource Hub provides links to both standard documents and educational resources to help organizations.

PCI Compliant Hosting PCI DSS and Online Payment Process Temok Hosting Blog

PCI Security Standards Council

PCI SSC publishes PCI Data Security Standard v4.0 Security MEA

The Payment Card Industry Data Security Standard (PCI DSS) is a widely accepted set of policies and procedures intended to optimize the security of credit, debit and cash card transactions and protect cardholders against misuse of their personal information. PCI DSS was designed to prevent cybersecurity breaches of sensitive data and reduce the risk of fraud for organizations that handle.

Understanding PCI DSS Introduction to Payment Card Industry Data Security Standard YouTube

The second is after March 31, 2024, when the current version of the standard PCI DSS 3.2.1 retires. All assessments completed on or after April 1, 2024, will need to be under PCI DSS 4.0. Finally, the remaining 51 new requirements are best practices until March 31, 2025, and are required to be in place on April 1, 2025.

- Avicularia Avicularia Pink Toe Tarantula

- All I See Is You Ende Erklärung

- Pfundstopf Aus Dem Dutch Oven

- Bandera Roja Blanca Y Azul

- Beste Bratpfanne Mit Abnehmbaren Griff

- Innisfree Green Tea Seed Serum

- Was Bedeutet Das Sternzeichen Steinbock

- Wie Alt Ist Rudy Giovannini

- Schaschlik Sauce Wie Im Imbiss

- Wo Kauft Man Sushi Lachs