Brutto Netto Rechner 2022 Ihr Gehaltsrechner

Brutto Gehalt, or Gross Salary, denotes the total earnings of an individual before any deductions are made. This figure includes the basic salary, allowances, bonuses, and any other monetary benefits accorded by the employer. It represents the full cost of employment from the employer's perspective, embodying the Employer Salary Costs.

Netto und Brutto » Definition, Erklärung & Beispiele + Übungsfragen

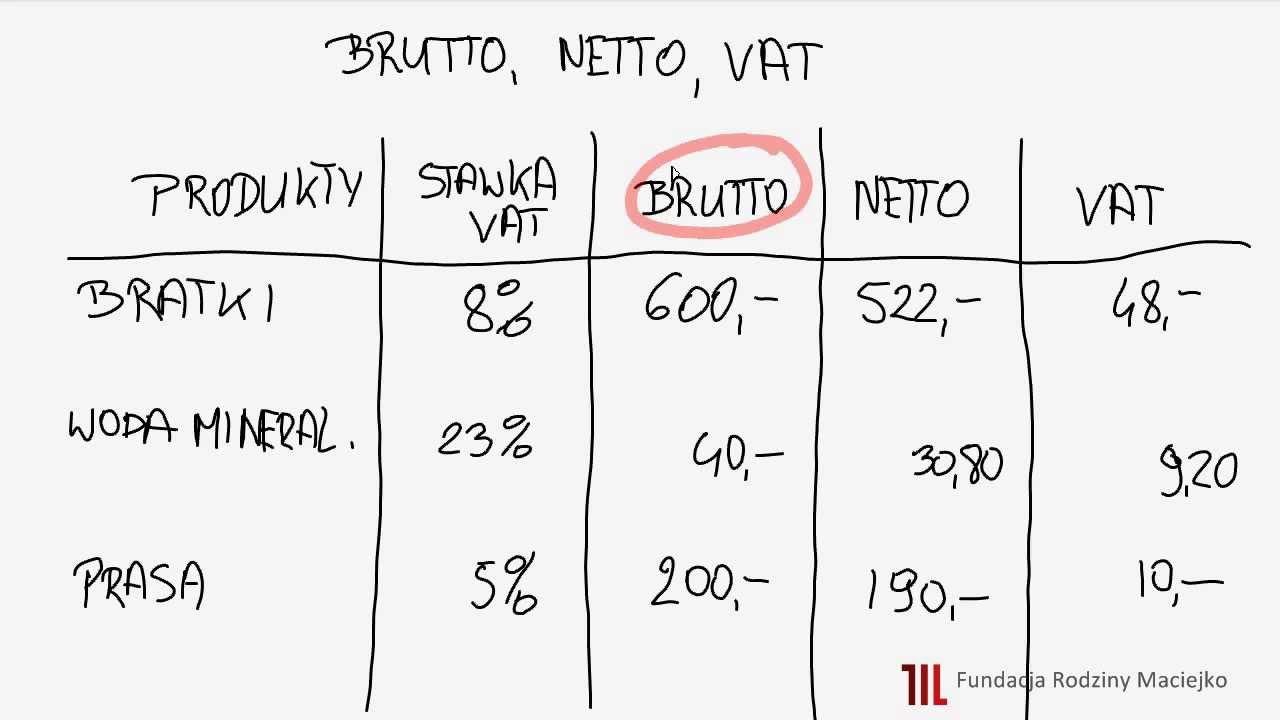

Brutto(gross) salary is best defined as the sum of salary before the deduction of tax and insurance(s). Netto(net) salary is the result of initial pay including tax and other sorts of deductions made. These deductions depend on local/national legislation where employees are required to pay certain amounts of tax to the government.

Brutto Netto Rechnung Alles was du wissen musst! YouTube

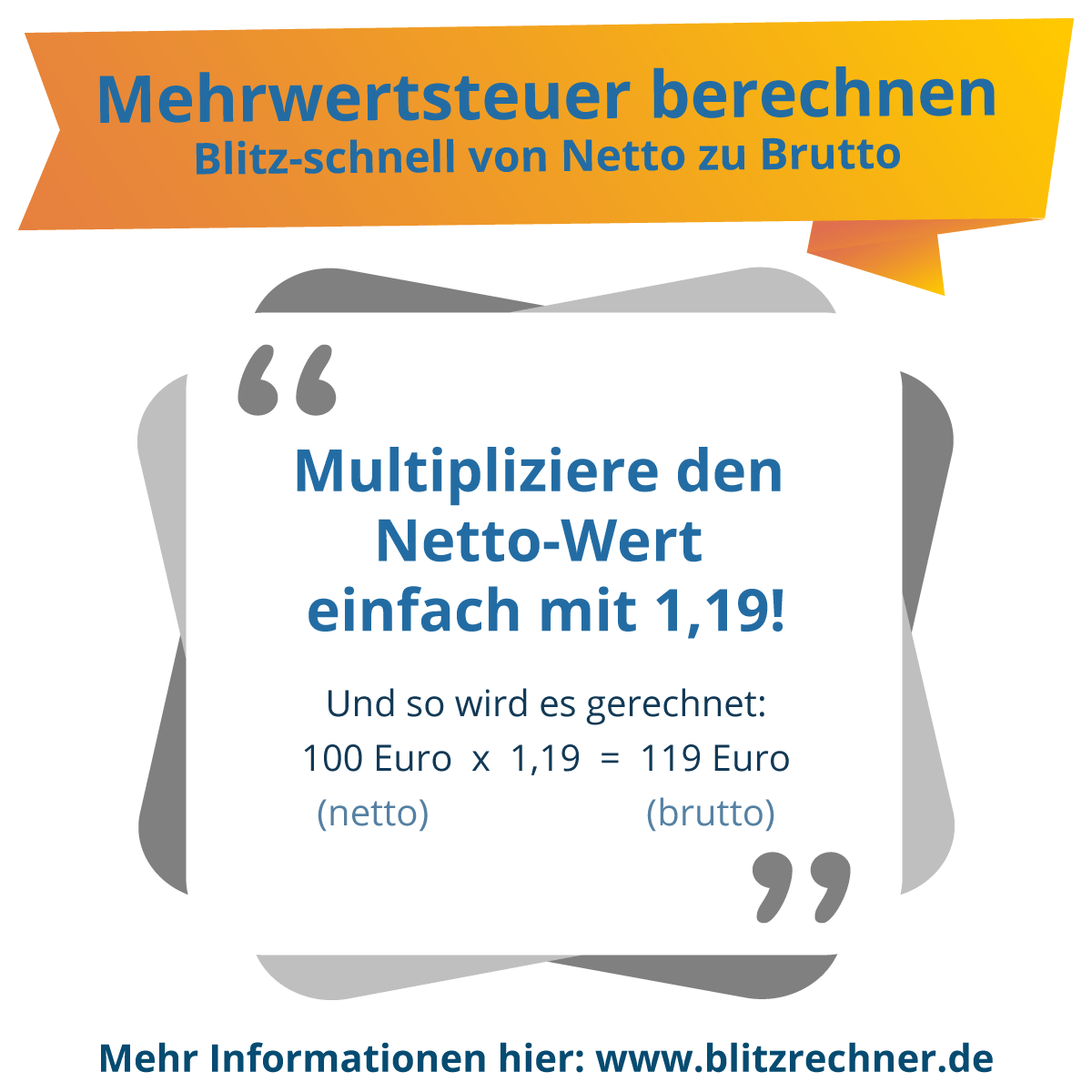

Der Brutto Netto Rechner 2024 ist ein kostenloser Service zur Berechnung der Steuern und Abgaben in Abhängigkeit zu Ihrem Bruttoeinkommen. Er ermittelt die Lohnsteuer, den Solidaritätszuschlag, die Kirchensteuer, Beiträge zur Rentenversicherung, Krankenversicherung, Arbeitslosenversicherung, Pflegeversicherung und den Geldwerten Vorteil bei der Nutzung eines Firmenwagens.

Netto vs brutto czym się różnią? Jak obliczyć wynagrodzenie? blog Credy

You can find the explanations of factors that are considered in your tax calculation that are used in a Brutto Netto Rechner. What is Gross Salary (Brutto)? This is your salary before taxes are applied or calculated. When companies offer an employment contract, the salary mentioned on there is Gross Salary..

Berechnen Sie hier Ihren Nettolohn

Netto Income = Total Revenue - Total Expenses. For individuals, this means your salary, investment earnings, and other sources of income minus your living expenses, taxes, and other obligations. For businesses, revenue comes from sales, while expenses include costs like rent, salaries, and operating expenses.

Czym się różni wartość brutto od netto?

Netto heißt "ohne Steuer". Brutto bedeutet "inklusive Steuer". Die beiden Begriffe sind besonders im Steuerrecht relevant. Im Lohnsteuerrecht wird einem sozialversicherungspflichtig beschäftigten Arbeitnehmer neben den Sozialversicherungsbeiträgen auch die Lohnsteuer von seinem Bruttolohn abgezogen. Der Auszahlungsbetrag ist mit dem.

Was ist der Unterschied zwischen Brutto und Netto? YouTube

Gross weight is the total weight of goods, including the raw product, any packaging, and possibly the vessel transporting the goods. Net weight is the raw weight of the product only without any packaging. Weight Calculation. Gross weight = net weight + packaging/ container weight. Net weight = gross weight - tare weight.

MehrwertsteuerRechner Brutto, Netto, MwSt von blitzrechner.de

Brutto vs. Netto Income The first thing I learned upon arrival in Germany was the distinction between "Brutto" and "Netto" income. "Brutto" refers to your gross income, which is the total amount.

Unterschied zwischen Brutto und Netto verstehen, 6 Beispiele zum Lernen

If you are living in Germany, in Berlin, and earning a gross annual salary (Bruttogehalt) of €49,260, or €4,105 per month, the total amount of taxes and contributions that will be deducted from your salary is €17,119. This means that your net income, or salary after tax (Nettogehalt), will be €32,141 per year, €2,678 per month, or €618 per week.

Der Unterschied zwischen Netto und Bruttorechnung Comarch ERP XT

A look in the dictionary helps to get a definition and explanation and thus derive their meaning in German: According to it, brutto can be translated as "raw" or "impure", indicating the unprocessed character of something. Thus, brutto refers to an amount without deductions.

Brutto — einfache Definition & Erklärung » Lexikon

What is a Gehaltsrechner or Brutto Netto Rechner? A Gehaltsrechner is the German word for a Salary Calculator. If you do speak German, the Federal Ministry of Finance has an official "Berechnung der Lohnsteuer" (A calculator for Wage Tax) that provides a lot of options. Brutto Netto Rechner simply translates to Gross Salary Calculator.

Brutto, Netto Was ist der Unterschied? azubister

The employment contract usually shows the gross salary, while the net salary is paid to the account. Employers have to deduct part of the gross salary, in the form of taxes and social security contributions, and then remit this to the tax office or social security provider. The remaining net salary is paid to the employees.

YouTube

The actual netto depends on many things. While the amount you get from your employer is predictable and only a function of the brutto, it might be corrected by a lot come tax return season. Depends who you talk to - among friends or family, you just use Netto. If it's tax related, Brutto.

Brutto VS Netto Was ist der Unterschied? 👀 Studitemps Erklärvideos YouTube

2.5% of your gross monthly salary is deducted as unemployment insurance, to serve and support you well during any unemployment crisis. The deduction percentages from gross salary could vary. But after all these deductions the net (Netto) salary you receive each month is approximately 60% of your gross (Brutto) monthly salary in Germany.

3400 Brutto In Netto

Sinngemäß bedeutet Brutto VOR Abzug der Steuern und Netto NACH Abzug der Steuern. Am besten merkst du dir das mit einer Eselsbrücke: Vor Abzug der Steuern hast du brut al viel Geld → brutto. Nach Abzug der Steuern hast du net mehr so viel Geld → netto. Spannend ist der Unterschied zwischen netto und brutto vor allem bei deinem Gehalt.

Care Potentials

Brutto (gross) salary is best defined as the sum of salary before the deduction of tax and insurance (s). Netto (net) salary is the result of initial pay including tax and other sorts of deductions made. These deductions depend on local/national legislation where employees are required to pay certain amounts of tax to the government.